How Home Morgages can Save You Time, Stress, and Money.

Why do realty experts require to understand about Reverse Home loans? Licensees are frequently the very first point of contact when people start to make housing changes. Having a standard knowledge of the Reverse Home loan item will help licensees to much better serve their customers and customers. As infant boomers consider downsizing, upsizing, aging in place, or making any housing transitions, all alternatives can be presented. 1996 changed to allow 1-4 household homes, as long as 1 unit is owner inhabited. 2000-2005 saw minor modifications and follow up with customers 2008 The Safe Act was established and Safeguards put in location for customers, and standards for counseling. 2009 The HECM (Home Equity Conversion Home mortgage) for purchase is introduced 2013 HUD put brand-new HECM polices that make the product safe, more powerful and less risky.

This is the first time the HECM loaning limit has been raised since President Barack Obama signed into law the American Healing and Reinvestment Act in 2009. Declared by the FHA on December 1, 2016, it went into impact on January 1, 2017 and will continue through December 31, 2017.

The Best Strategy To Use For Residential Mortages

Home must satisfy FHA property requirements and be a 1-4 family home or FHA approved condo Advantages of Reverse Home Loans Ability to "age in location"- use home equity to preserve a more comfy standard of life in the current home. Can be utilized to acquire a brand-new primary residence * with no home mortgage payments.

Property owner is accountable for paying real estate tax, house owners insurance coverage and property owner association dues, if relevant Safeguards/Consumer Protections Overseen by HUD (Real Estate & Urban Development) Guaranteed by FHA Prospective customers must receive therapy by a HUD approved Real estate Therapist before sending an application for reverse home loan In MA, Counseling should be done Face to Face Counseling carried out by Independent 3rd party housing counseling company Counselors are HUD approved, examination qualified, professionals How Much Cash can be gotten.

Unknown Facts About Mortgages

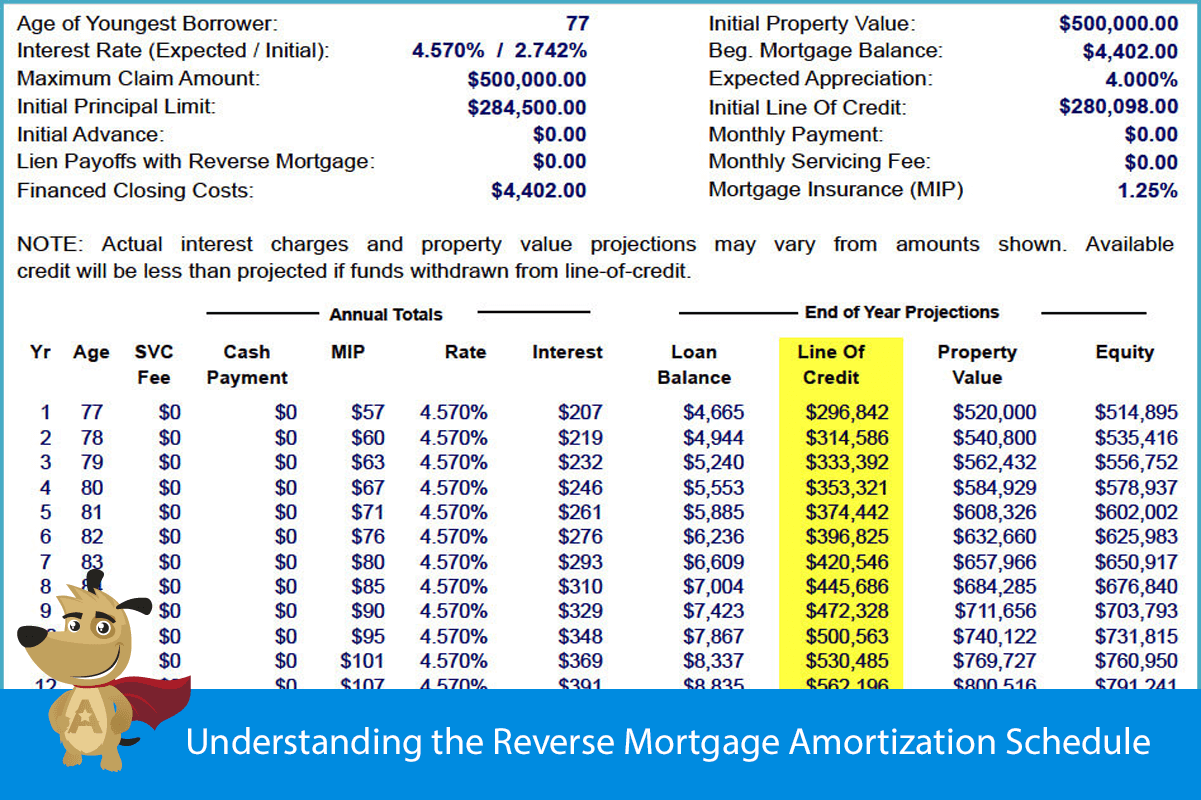

Cost of Reverse Mortgage Origination charge (max is $6000 and waived on a purchase) Home mortgage Insurance fee (in advance range between 2% of residential or commercial property value and.05% of loan balance Traditional closing expenses: title, appraisal, flood certs Inspections Home and Pest may be needed for existing building A state requirement An agreement requirement An appraiser requirement An underwriter sees possible issue noted on the appraisal Study May be needed by a licensed property surveyor if: There is a discrepancy in the legal description Lot size or ingress/egress Well or septic remain in concern Infringements are present The appraiser or underwriter calls for it Pay out choices Swelling sum A withdrawal of your offered benefit at loan closing, to settle your existing mortgage balance, if any, and to provide cash Fixed Monthly Payments Period: a fixed regular monthly payment for as long as you remain the home Term: a repaired regular monthly payment for a particular term the borrower chooses Line of Credit A credit limit the debtor can access at any time.

A mix of any of these choices. Differences in between a Home Equity Credit Line and a Reverse Credit Line Greater flexibility in repayment. No month-to-month payments required UNLESS the customer passes away, no longer lives n the home or stop working to pay taxes and insurance coverage & preserve the home HECM can be paid back at any time without penalty.

A Biased View of Reverse Mortgage

Minimal income and property qualifications Adjustable rate HECMs use a credit limit growth rate, so the unused portion increases with time. How a Reverse Home mortgage can assist your clients Prevent offering properties to keep cash Use funds to buy a trip home without depleting considerable amounts of assets. Get tax-free profits to assist with everyday living expenditures.

The deal includes the sale of an existing home, or using funds from other approved methods, toward the purchase of a brand-new primary residence. The HECM for Purchase financial resources the remaining balance. The new home needs to be owner inhabited within 60 days of closing. A minimum of 1 customer must be 62 or older to qualify Process & Protections Therapy (counseling certificate needed) All debtors should be counseled by HUD authorized therapy firm.

Mortgages Things To Know Before http://marilynjunevshe.theglensecret.com/the-advanced-guide-to-reverse-mortgage You Get This

Certificate benefits 180 days. Fee ranges from $125-$250 per couple and undergoes alter Therapy packet includes financing assessment and details to get the mandatory therapy. (HUD approved therapist) Prequalification is offered Review of P&S before last signing Amendatory/Escape Stipulation signed with the contract Genuine estate accreditation signed with the contract Application is processed Appraisal Examinations Title Underwriting Closing No TRID, no Closing Disclosure.

The 4 NEVERS of Reverse Home Mortgage (Pros) The homeowner & his estate NEVER quit the title to the house The property owner, when leaving your house to his estate, can NEVER EVER owe more than the houses values. When the home is offered, proceeds in excess of the financial obligation come from the homeowner or his estate.

All about Residential Mortages

Month-to-month payments are NEVER required or anticipated, although voluntary payments are accepted. Caveats to think about (Cons) There is less money left to the heirs. You are making the equity in your home liquid and therefore useable. When utilized, there is less available for successors. Residential or commercial property taxes and resident insurance coverage should be kept existing Home must be maintained and kept in good repair Home need to remain as your primary home, or the loan will become due.

Foreclosure The loan ends up being due and payable with the following maturity events: Non payment of home taxes Non payment of homeowner's insurance Not preserving the property in the condition it was bought Moving out, selling or when the last customer passes away. Effect of death of a partner If one partner dies, absolutely nothing changes offered both were on the loan originally.

5 Easy Facts About Home Morgages Explained

2167 (2013) Massachusetts Laws 209 CMR 55.00 Reverse Mortgage M.G.L.c 167E Section 7Aand M.G.L. c 171 Section 65C 1/2 SUGGESTED HANDOUTS: Retirement Trends and the Reverse Home Mortgage by David W. Johnson, Ph. D.; and Zamira S. Simkins, Ph. D. Reversing the Standard Knowledge by Barry and Stephen Sacks, J.D., Ph.

D The Federal government's Redesigned Reverse Home loan Program by Alicia H. Munnell and Steven A. Sass The New Case for Reverse Home Loans by Wade Pfau, Ph. D., CFA.

Mortgages - Truths

A reverse home mortgage runs in the opposite manner of a conventional home mortgage. With a conventional mortgage, the house owner pays the lender, reducing financial obligation (the mortgage balance) and increasing equity (ownership) in the house gradually. With a reverse home mortgage, the lender pays the property owner-- there are no monthly payments to the lender.