7 Easy Facts About What Financial Advisors Do Described

Run a background look at your organizer. Start with these 2 questions: Have you ever been founded guilty of a criminal activity? Has any regulative body or investment-industry group ever put you under investigation, even if you weren't condemned or accountable? Then request references of existing customers whose http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/financial advice objectives and finances match yours.

Google them, see who administers the classification, then call that administrator to verify that the credential stands. If your advisor is a CFP, discipline records are located here. Be careful of market-beating boasts. Warren Buffet outshines the marketplace averages. There aren't https://en.search.wordpress.com/?src=organic&q=financial advice a lot of individuals like him. If you have an initial meeting with an advisor and you hear forecasts of market-beating performance, get up and leave.

Asking somebody whether they'll beat the market is a pretty great base test for whether you want to work with them. What they need to be appealing is excellent advice across a range of issues, not just investments. And inside your portfolio, they ought to be asking you about the number of risks you wish to take, for how long your time horizon is Financial Advisors and extoling their capability to help you attain your objectives while keeping you from losing your t-shirt when the economy or the marketplaces sag.

Quick Navigation: What does a monetary advisor do? Typical income Financial consultant requirements Financial consultant workplace How to become a monetary advisor Financial advisor job description example Related professions Financial Consultant Snapshot National Average Income: $66,415 each year Frequently Required Abilities: Communication abilities, interpersonal abilities, analytical skills Entry-Level Requirements: Bachelor's degree A financial consultant provides advice on financial investments, insurance, taxes, retirement and other elements to help individuals handle their short- and long-lasting financial resources.

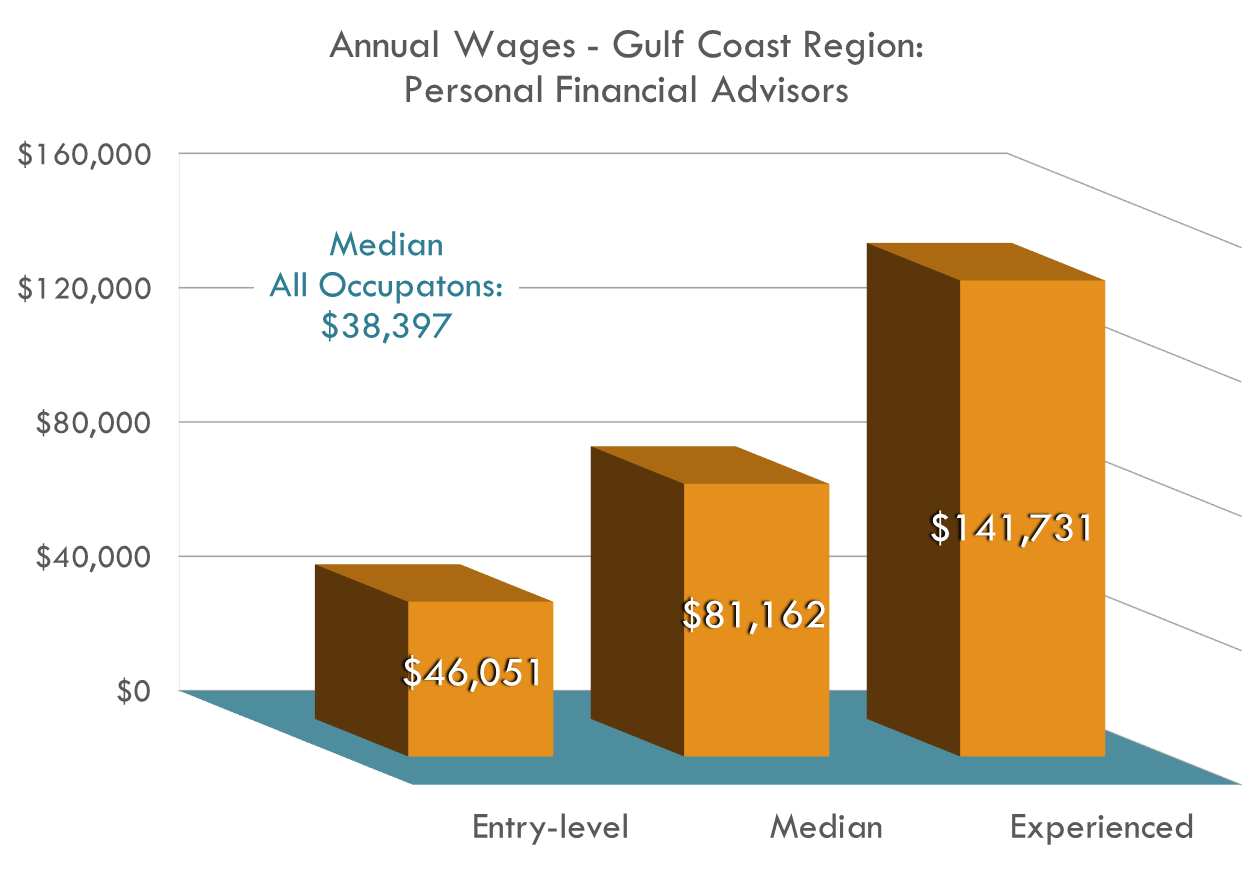

These specialists likewise recommend investments to customers or choose investments on their behalf. Some additional responsibilities of a monetary advisor may consist of: Looking into investment opportunities for customers Supplying tax recommendations and selling insurance coverage items that help clients satisfy their monetary goals Informing customers about investment options and potential threats while responding to any questions they may have Helping clients prepare financially for education, retirement or tradition Providing services for significant life changes, such as marrying or having children Monitoring customer accounts to identify if they require to make modifications to their financial investment strategy to enhance financial efficiency or accommodate expected life modifications Wages for monetary advisors might depend on their level of education, experience and skills, as well as the position's particular job obligations.

The Facts About Advise From Financial Experts Revealed

Common wage in the U.S.: $66,415 per year Some incomes range from $14,000 to $192,000 annually The essential education and training to become a monetary consultant depend on the obligations of the position. However, there are some standard requirements basic across the occupation: Education Training Accreditations Skills A monetary advisor usually The original source needs to hold at least a bachelor's degree.

Getting a master's degree in financing or organisation administration is not essential, however it can help candidates enhance their chances of advancement in this profession and help them draw in more customers. Courses in taxes, estate preparation, financial investment and risk management can likewise be useful for those who wish to become financial advisors.

Financial advisors get many of their training while on the task, and many professionals have an initial training duration that lasts a year or longer. During this training duration, brand-new monetary advisors work under the supervision of knowledgeable consultants while learning how to perform tasks vital to the task, including building a network of clients and developing investment portfolios.

Throughout an internship, a trainee can make practical experience in a financial setting. They may likewise get in touch with monetary professionals who can help them in finding a job after graduation. Some master's programs might require students to go through an internship as part of its graduation guidelines. Certifications needed for financial consultants depend upon the particular position and job duties: Financial Industry Regulatory Authority licenses-Series 6 and Series 7: The Series 6 license allows an advisor to offer insurance coverage premiums, annuities and mutual funds, while a Series 7 license authorizes them to sell stocks and bonds.

North American Securities Administration Association licenses-Series 65 and Series https://www.washingtonpost.com/newssearch/?query=financial advice 66: NASAA offers Series 65 and Series 66 licenses for financial consultants. Most states require financial advisors to have an active Series 65 license, and a Series 66 license enables https://www.liveinternet.ru/users/xippusmhis/post463904204// an individual to work as an investment consultant. Both licenses require Financial Advisor Duties prospects to pass an examination, and advisors require to renew them based on NASAA's latest requirements.

Getting The Professional Financial Advise To Work

To earn the CFP classification, candidates need to hold at least a bachelor's degree from an accredited institution, at least three years of relevant experience and earn a passing grade on the examination. They likewise need to undergo a background check to ensure they can meet the standards of conduct.

While financial advisors will discover the majority of the essential abilities for this position as part of their degree program and throughout on-the-job training, there are other skills that candidates can get outside of the field. Here are a few of the most appropriate and essential skills financial consultants need to establish: Analytical: To determine the best investment choices for their customers, financial consultants require to be able to process and examine a wide variety of details, consisting of investment trends, regulatory modifications and the client's danger tolerance.

Interpersonal: Making customers feel comfy and supported is an important part of the financial consultant's job. Advisors establish trust with their customers so that they can learn how best to assist each individual plan financially for the future. Financial advisors likewise establish relationship and connect with their customers to assist them.

This will typically need the expert to adjust their interaction style to respond to their questions and concerns their customers might have concerning investments, retirement, insurance coverage and other financial topics. Mathematical: These experts deal with numbers every day. For this reason, it is very important that experts who pursue this career course are great at mathematics.

They likewise anticipate future trends that might impact financial investments or risk. Sales: Financial consultants are generally competent sellers because they need to bring in and retain new customers. These specialists must be confident, persuading and consistent when selling their services. A comprehensive understanding of product or services can assist professionals construct this confidence and better understand the finest method to offer these products.

9 Easy Facts About Advise From Financial Experts Described

The bulk of these experts operate in securities, commodity contracts and other monetary investment-related activities. Nevertheless, they can likewise work in credit mediation, insurance or as self-employed individuals. Many financial consultants work complete time with some working more than 40 hours weekly. Because these professionals need to accommodate their customers' schedules, they might have conferences after workplace hours and on the weekends.

A typical work environment for a monetary consultant consists of: Sitting for extended amount of times at a desk while working on a computer system Communicating with others in their office Sending correspondence through e-mail and text Preparing declarations and answering customer concerns Utilizing a workplace phone, mobile phone or conferencing tools Lots of specialists go through the following actions to pursue a profession as a financial consultant: Acquire a high school diploma.