Top Guidelines Of Mortgages

This is the only alternative that features a set rate of interest. The other 5 have adjustable interest rates. Equal month-to-month payments (annuity): For as long as at least one debtor lives in the home as a primary residence, the loan provider will make stable payments to the borrower. Term payments: The loan provider provides the borrower equivalent month-to-month payments for a set duration of the borrower's choosing, such as ten years.

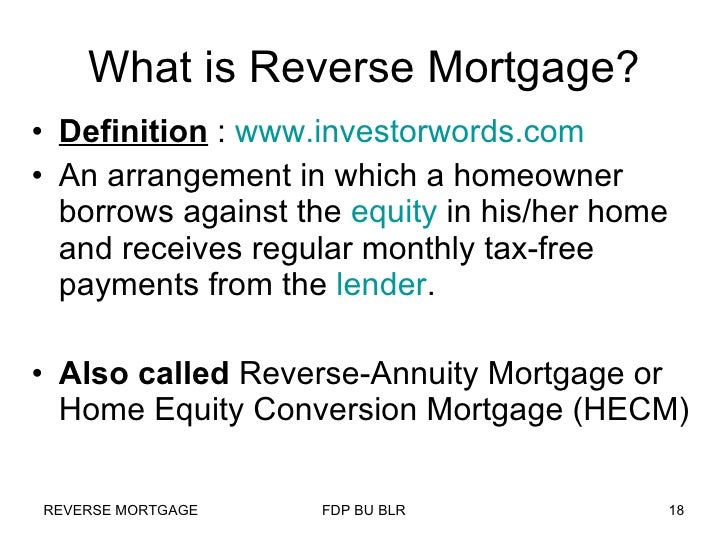

The It's likewise possible to utilize a reverse mortgage called a "HECM for purchase" to buy a different house than the one you currently reside in. In any case, you will typically require a minimum of 50% equity-- based upon your home's existing value, not what you paid for it-- to get approved for a reverse mortgage.

The Facts About Reverse Mortgage Uncovered

41,736 The variety of reverse mortgages issued in the U.S. in 2018, down 26.7% from the previous year. A reverse home mortgage might sound a lot like a home equity loan or line of credit. Undoubtedly, comparable to among these loans, a reverse home loan can provide a https://en.search.wordpress.com/?src=organic&q=reverse mortages swelling amount or a line of credit that you can access as needed based upon how much of your house you have actually settled and your home's market worth.

A reverse mortgage is the only method to gain access to house equity without selling the home for seniors who don't desire the responsibility of making a month-to-month loan payment or who can't get approved for a house equity loan or re-finance due to the fact that of minimal cash flow or bad credit. If you do not get approved for any of these loans, what options remain for utilizing house equity to money your retirement!.?. !? You might sell and scale down, or you might offer your house to your children or grandchildren to keep it in the family, possibly even becoming their tenant if you want to continue living in the home.

Indicators on Reverse Mortgage You Need To Know

A reverse home loan allows you to keep living in your house as long as you stay up to date with property taxes, upkeep, and insurance and don't require to move into a nursing house or helped living facility for more than a year. However, taking out a reverse home mortgage suggests spending a substantial quantity of the equity you've collected on interest and loan fees, which we Reverse Mortage Tips will talk about below.

If a reverse home mortgage does not provide a long-lasting service to your monetary issues, just a short-term one, it may not be worth the sacrifice. What if somebody else, such as a buddy, relative or roomie, copes Residential Mortages with you? If you get a reverse mortgage, that individual won't have any right to keep residing in the home after you pass away.

Top Guidelines Of Reverse Mortage Tips

If you pick a payment strategy that does not offer a lifetime income, such as a swelling sum or term strategy, or if you get a credit line and utilize all of it up, you might not have any money left when you require it. If you own a home, condo or townhouse, or a manufactured home built on or after June 15, 1976, you may be qualified for a reverse home mortgage.

In New York, where co-ops are common, state law even more restricts reverse home mortgages in co-ops, allowing them just in one- to four-family residences and condos. While reverse home mortgages do not have income or credit report requirements, they still have rules about who certifies. You must be at least 62, and you must either own your home totally free and clear or have a substantial amount of equity (a minimum of 50%).

Home Morgages Things To Know Before You Get This

The federal government limits just how much lending institutions can charge for these products. Lenders can't go after customers or their successors if the house ends up being underwater when it's time to offer. They likewise should enable any heirs numerous months to choose whether they wish to repay the reverse home loan or permit the lender to offer the house to settle the loan.

This therapy session, which typically costs around $125, should take a minimum of 90 minutes and should cover the pros and cons of securing a reverse home mortgage offered your special financial and personal circumstances. It should describe how a reverse home mortgage could impact your eligibility http://www.bbc.co.uk/search?q=reverse mortages for Medicaid http://www.thefreedictionary.com/reverse mortages and Supplemental Security Income.

Top Guidelines Of Reverse Mortage Tips

Your responsibilities under the reverse home mortgage guidelines are to remain existing on real estate tax and house owners insurance and keep the house in excellent repair. And if you stop living in the home for longer than one year-- even if it's since you're living in a long-lasting care facility for medical factors-- you'll have to repay the loan, which is typically accomplished by offering your house.

In spite of current reforms, there are still circumstances when a widow or widower could lose the home upon their partner's death. The Department of Housing and Urban Advancement changed the insurance premiums for reverse mortgages in October 2017. Considering that lending institutions can't ask house owners or their heirs to pay up if the loan balance grows bigger than the house's worth, the insurance premiums provide a pool of funds that lending institutions can make use of so they don't lose cash when this does take place.

All About Reverse Mortgage

The up-front premium utilized to be tied to how much debtors got in Go here the first year, with homeowners who took out the most-- due to the fact that they needed to pay off a current mortgage-- paying the higher rate. Now, all borrowers pay the exact same 2.0% rate. The up-front premium is computed based upon the house's worth, so marilynstarkweatherjunevnrj.tearosediner.net/10-quick-tips-about-mortgage-electronic-registration-systems-inc for every single $100,000 in assessed worth, you pay $2,000.

All customers must also pay yearly home mortgage insurance coverage premiums of 0.5% (formerly 1.25%) of the quantity obtained. This change conserves debtors $750 a year for every $100,000 borrowed and assists offset the higher up-front premium. It likewise suggests the debtor's financial obligation grows more gradually, protecting more of the house owner's equity in time, offering a source of funds later on in life or increasing the possibility of having the ability to pass the home down to successors.

4 Easy Facts About Mortgages Explained

Reverse home loans are a specialized product, and only certain lenders offer them. Some of the most significant names in reverse mortgage lending consist of American Advisors Group, One Reverse Home Mortgage, and Liberty Home Equity Solutions. It's a great concept to get a reverse home loan with numerous business to see which has the least expensive rates and fees.

Only the lump-sum reverse mortgage, which provides you all the proceeds at the same time when your loan closes, has a fixed rates of interest. The other 5 options have adjustable interest rates, which makes sense, since you're obtaining money over several years, not at one time, and rates of interest are constantly altering.