About Professional Financial Advise

Getting recommendations in composing is always an excellent concept, as it leaves no question as to what strategy was advised. An excellent financial planner will not make suggestions till they comprehend your objectives and have run a long-lasting monetary prepare for you. If you meet somebody who begins speaking about a monetary product right now, even if they call themselves a financial organizer, they are more most likely a monetary salesperson.

You'll find that fee structures vary. http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/financial advice Typically, monetary planners charge costs in among the following methods: A https://en.wikipedia.org/wiki/?search=financial advice hourly rate A flat fee to finish a particular project A quarterly or yearly retainer cost A fee charged as a portion of assets that they manage on your behalf (Typically anywhere between 0.5% each year to 2% each year.

If they work as a registered https://brooklynne.net/profiles/blogs/breaking-it-down-picking-necessary-aspects-of-advise-from investment advisor, they should provide you with a disclosure file called an ADV, which includes two parts. Part two will offer details on all costs and any prospective disputes of interest. Financial investment guidance can range from a general recommendation as to what type of property allotment model you ought to follow, to particular recommendations on which financial investments to purchase and sell.

You might question what a financial consultant does with your money and how this expert chooses the very best financial investments and course of action for you. This post breaks down precisely what a monetary consultant does. You \ l comprehend the advisory process and how an advisor chooses appropriate financial investments for you.

Advisors utilize their understanding and competence to build tailored monetary strategies that intend to accomplish the financial goals of clients. These plans include not only financial investments but likewise cost savings, https://www.washingtonpost.com/newssearch/?query=financial advice spending plan, insurance coverage, and tax methods. Advisors even more check in with their customers on a regular basis to re-evaluate their existing situation and future goals and strategy appropriately.

The Ultimate Guide To What Financial Advisors Do

Let's state you desire to ideal licenses to help make these plans a truth, and that's where a financial advisor is available in. Together, you and your consultant will cover many topics, consisting of the amount of money you must save, the kinds of accounts you require, the kinds of insurance you need to have (consisting of long-lasting care, term life, and disability) and estate and tax preparation.

Part of the advisor's job is to assist you understand what is included in fulfilling your future objectives. The education procedure might include detailed aid with financial topics. At the start of your relationship, those subjects could be budgeting and saving. As you advance in your understanding, the advisor will assist you in comprehending complex investment, insurance, and tax matters.

On the survey, you will likewise indicate future pensions and income sources, job retirement needs and describe any long-term monetary responsibilities. In short, you'll note all existing and predicted financial investments, pensions, presents and income sources. The investing part of the survey discuss more subjective subjects, such as your The initial evaluation also consists of an examination of other monetary management topics such as insurance issues and your tax circumstance.

Once you and the consultant understand your present financial position and future forecasts, you're all set to interact on a strategy to meet your life and monetary objectives. The financial consultant synthesizes all of this preliminary details into a liabilities, and liquid or working capital. The financial strategy also evaluates the goals you and the advisor discussed.

Based upon your anticipated net worth and future income at retirement, the plan will create simulations of potentially finest- and worst-case retirement situations, including the scary possibility of outliving your cash, so actions can be required to avoid that outcome. It will take a look at sensible withdrawal rates in retirement from your portfolio possessions.

More About Financial Advisors

After you review the strategy with the advisor and adjust it as needed, you're all set for action. A financial advisor is not just somebody who aids with investments. Their task is to assist you with every element of your monetary life. In fact, you could work with a monetary advisor without having them manage your portfolio or recommend investments at all.

If you pick this route, here's what to expect. The consultant will establish a property allowance that fits both your risk tolerance and risk capability. The asset allowance is simply a rubric to determine what percentage of your overall monetary portfolio will be dispersed throughout different asset classes. A more risk-averse person will have a higher concentration of federal government bonds, certificates of deposit and money market holdings, while a person who is more comfy with danger will handle more stocks and corporate bonds and maybe financial investment realty.

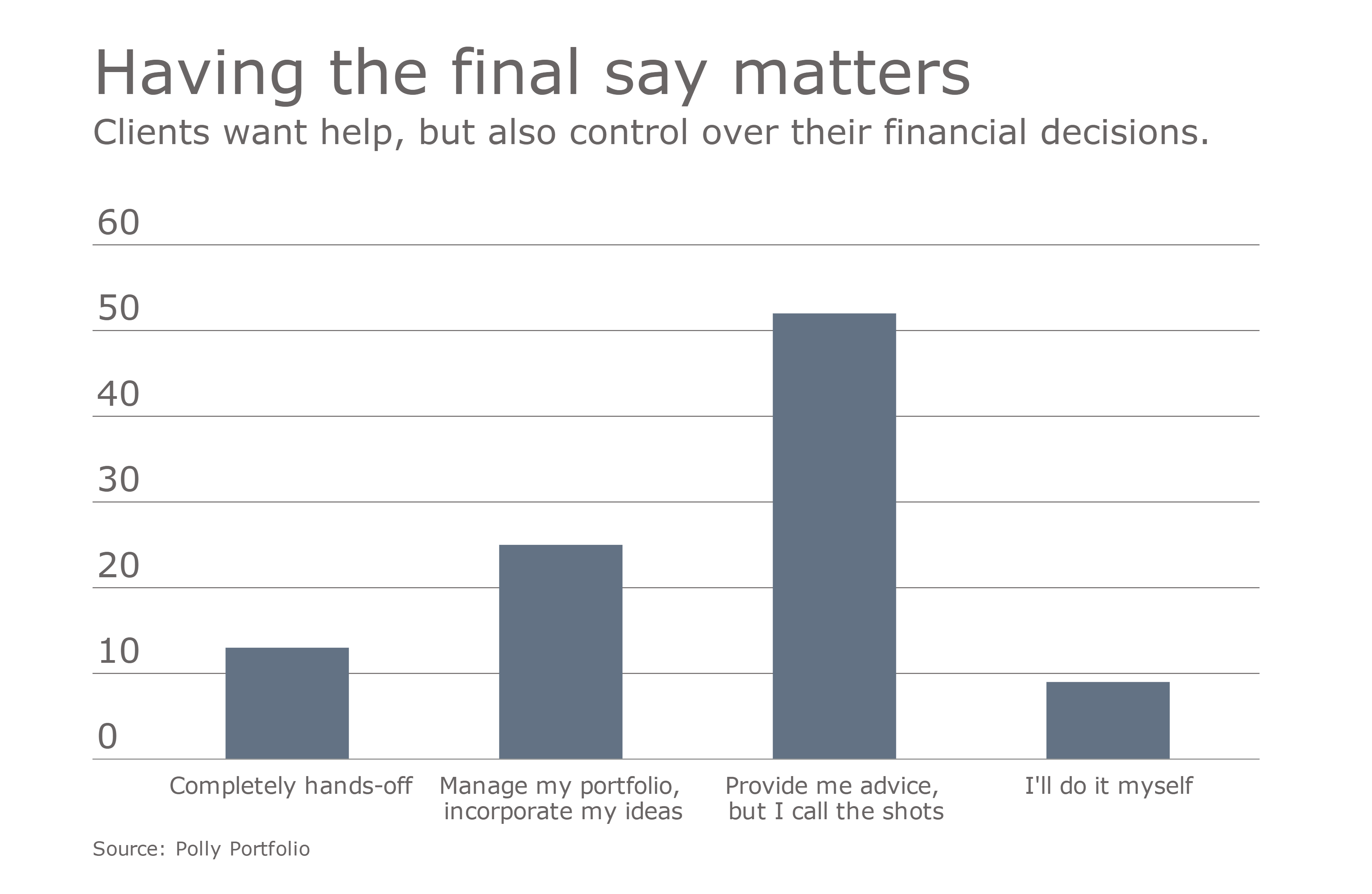

Each financial advisory firm will act in accordance with the law and with its business investment policy when purchasing and selling financial properties. It is very important for you, as the consumer, to comprehend what your organizer recommends and why. You ought to not blindly follow an advisor's recommendations; it's your money, and you must comprehend how it's being deployed.

Ask your advisor why they suggest specific financial investments and whether they are getting a commission for offering you those financial investments. Be alert for possible conflicts of interest. A commonness amongst companies is that financial items are picked to fit the client's risk profile. Take, for example, a 50-year-old man who's currently collected enough net worth for retirement and is predominantly interested in capital preservation.

While taking into consideration the company's investment approach, your individual portfolio will fit your needs based on how soon you require the cash, your financial investment horizon, and your present and future objectives. When your investment plan remains in location, you'll receive regular statements from your consultant updating you on your portfolio.

Top Guidelines Of What Financial Advisors Do

Meeting from another location by means of phone or video chat can help make those contacts take place more often. The choice to enlist professional assistance with your cash is a highly individual one, however at any time you're feeling overwhelmed, confused, stressed or frightened by your financial circumstance might be a great time to look for a monetary advisor.

Finally, if you don't have the time or interest to handle your finances, that's another excellent factor to hire a monetary consultant. Those are some general reasons you might need an advisor's expert help. Here are some more particular ones. Due to the fact that we live in a world of inflation, any cash you keep in cash or in a low-interest account declines in value each year.

Even the finest investors lose cash when the market is down or when they decide that does not end up as they 'd hoped, but in general, investing need to increase your net worth substantially. If it's refraining from doing that, hiring a monetary advisor can assist you learn what you're doing wrong and proper your course before it's too late.

And if you aren't appropriately guaranteed (or aren't sure what insurance coverage you require), a financial consultant can assist with that, too. Indeed, a fee-only financial advisor might be able to offer a less prejudiced viewpoint than an insurance agent can. Financial advisors can help you with investing and reaching your long-lasting objectives in many methods.