The 4-Minute Rule for Mortgages

Marketer Disclosure At Nerd Wallet, we aim to assist you make financial decisions with confidence. To do this, lots of or all of the items included here are from our partners. However, this does not affect our evaluations. Our viewpoints are our own. After retirement, without regular income, you may sometimes have a hard time with finances.

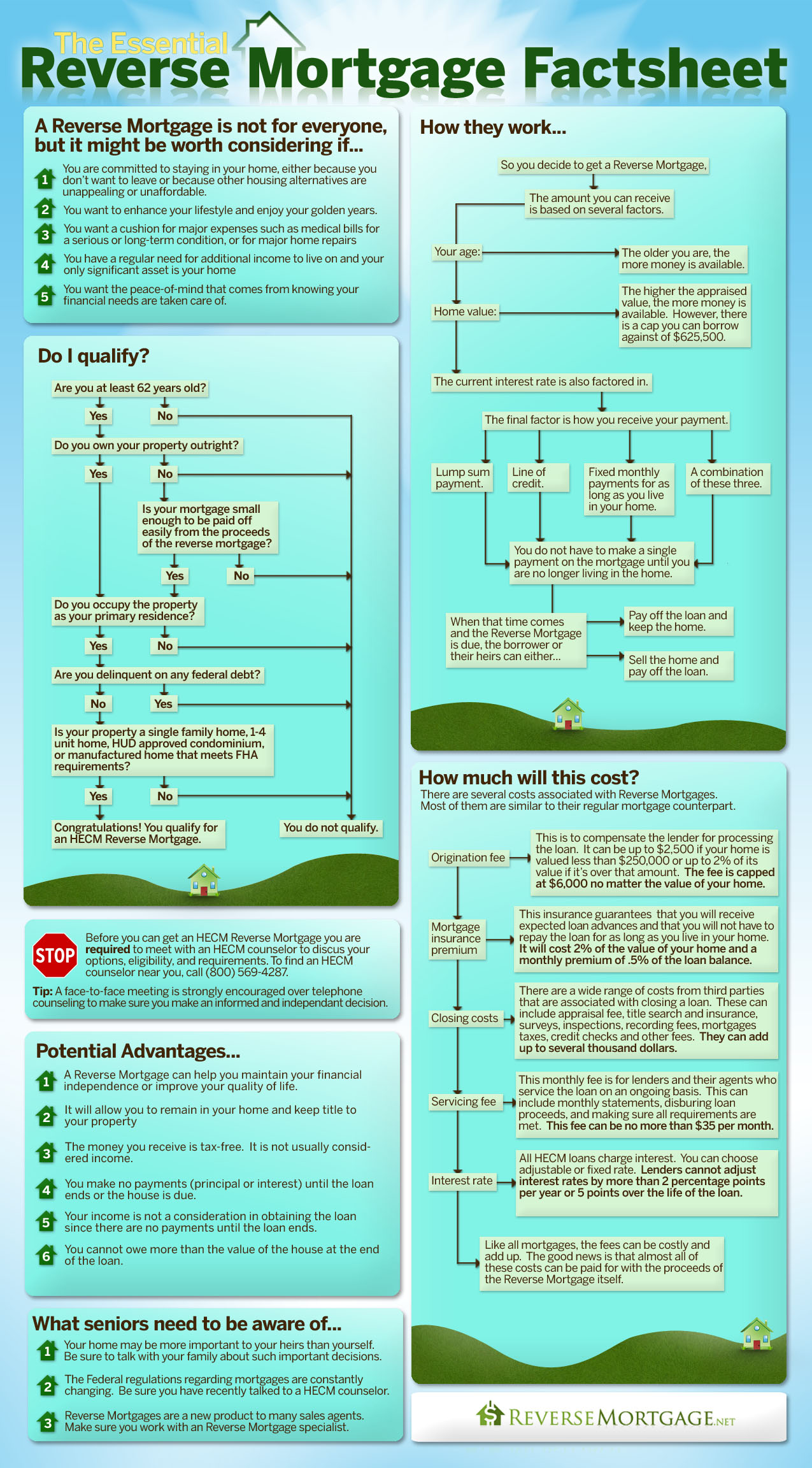

A reverse home mortgage is a home mortgage that allows house owners 62 and older to withdraw some of their home equity and transform it into money. You do not need to pay taxes on the earnings or make month-to-month mortgage payments. You can use reverse home mortgage profits however you like. They're typically allocated for costs such as: Financial obligation debt consolidation Living expenses Home enhancements Helping kids with college Buying another house that might much better fulfill your requirements as you age A reverse home mortgage is the reverse of a traditional mortgage; rather of paying a loan provider a month-to-month payment each month, the loan provider pays you.

The sum you receive in a reverse home loan is based upon a sliding scale of life span. The older you are, the more home equity you can take out." MORE: How to get a reverse home loan The Federal Housing Administration guarantees 2 reverse home mortgage types: adjustable-rate and a fixed-rate.

Fascination About Reverse Mortage Tips

2. Adjustables have five payment options: Tenure: Set regular monthly payments so long as you or your qualified partner stay in the home Term: Set monthly payments for a fixed period Credit line: Undefined payments when you require them, until you've exhausted your funds Modified tenure: A credit line and set month-to-month payments for as long as you or your qualified spouse reside in the house Customized term: A line of credit and set month-to-month payments for a set duration of your choosing To apply for a reverse home mortgage, you must satisfy the following FHA requirements: You're 62 or Home Morgages older You and/or a https://www.washingtonpost.com/newssearch/?query=reverse mortages qualified spouse-- who must be called as such on the loan even if she or he is not a co-borrower-- live in the house as your main residence You have no delinquent federal financial obligations You own your house outright or have a substantial amount of equity in it You attend the obligatory therapy session with a home equity conversion home loans (HECM) therapist authorized by the Department of Real Estate and Urban Advancement Your house satisfies all FHA home requirements and flood requirements You continue paying all real estate tax, house owners insurance coverage and other family upkeep charges as long as you live in the home https://en.search.wordpress.com/?src=organic&q=reverse mortages Prior to providing a reverse mortgage, a loan provider will examine your credit rating, verify your month-to-month income versus your regular monthly monetary responsibilities and order an appraisal on your house.

Almost all reverse home mortgages are issued as home equity conversion home mortgages (HECMs), which are guaranteed by the Federal Real Estate Administration. HECMs come with stringent loaning standards and a loan limit. If you believe a reverse mortgage might be ideal for you, discover an FHA-approved loan provider.

Are you considering whether a reverse home mortgage is right for you or an older homeowner you understand? Before thinking about one of these loans, it pays to know the realities about reverse home mortgages. A reverse mortgage, often called a House Equity Conversion Home Mortgage (HECM), is an unique type of loan for property owners aged 62 and older that lets you convert a portion of the equity in your house into money.

Home Morgages - An Overview

Securing a reverse mortgage is a big choice, given that you may not be able to leave this loan without offering your home to pay off the debt. You likewise need to carefully consider your alternatives to prevent using up all the equity you have actually constructed up in your house.

Reverse home loans typically are not utilized for holidays or other "fun" things. The truth is that a lot of borrowers use their loans for instant or pressing financial needs, such as settling their existing home loan or other financial obligations. Or they may consider these loans to supplement their month-to-month income, so they can afford to continue residing in their own home longer.

Taking out any home mortgage can be minds.com/naydiehavi/blog/the-top-reasons-people-succeed-in-the-mortgage-educators-ind-1048990962160574464 pricey due to the fact that of origination costs, servicing fees, and third-party closing charges such as an appraisal, title search, and tape-recording costs. You can pay for the majority of these http://edition.cnn.com/search/?text=reverse mortages expenses as part of the reverse home loan. Reverse home loan borrowers likewise must pay an in advance FHA home mortgage insurance premium.

All About Home Morgages

It likewise makes sure that, when the loan does end up being due and payable, you (or your successors) don't have to repay more than the worth of the house, even if the quantity due is greater than the appraised value. While the closing costs on a reverse home loan can in some residential mortgage group p/l cases be more than the costs of the home equity line of credit (HELOC), you do not need to make regular monthly payments to the lending institution with a reverse home mortgage.

It's never an excellent concept to make a financial choice under tension. Waiting up until a small concern becomes a big issue lowers your choices. If you wait till you remain in a financial crisis, a little additional income monthly probably will not help. Reverse home loans are best utilized as part of a sound financial plan, not as a crisis management tool.

Learn if you might qualify for aid with costs such as real estate tax, house energy, meals, and medications at Benefits Examine Up®. Reverse home loans are best used as part of an overall retirement strategy, and not when Reverse Mortgage there is a pending crisis. When HECMs were very first provided by the Department of Real Estate and Urban Advancement (HUD), a large percentage of borrowers were older women seeking to supplement their modest incomes.

Home Morgages Fundamentals Explained

During the real estate boom, numerous older couples secured reverse home mortgages to have a fund for emergency situations and extra money to take pleasure in life. In today's financial recession, more youthful customers (frequently Baby Boomers) are turning to these loans to manage their current mortgage or to help pay down debt. Reverse mortgages are special since the age of the youngest borrower determines just how much you can borrow.

Choosing whether to take out a reverse home mortgage loan is challenging. It's tough to estimate how long you'll remain in your home and what you'll require to live there over the long term. Federal law needs that all individuals who are thinking about a HECM reverse home loan get counseling by a HUD-approved therapy firm.

They will also discuss other options including public and private advantages that can help you stay independent longer. It's important to consult with a therapist before talking with a loan provider, so you get impartial details about the loan. Telephone-based counseling is available nationwide, and face-to-face therapy is readily available in numerous communities.

An Unbiased View of Residential Mortages

You can likewise discover a therapist in your location at the HUD HECM Counselor Roster. It is possible for reverse home mortgage borrowers to face foreclosure if they do not pay their real estate tax or insurance, or maintain their home in great repair work. This is especially a danger for older property owners who take the entire loan as a swelling amount and invest it quickly-- maybe as a last-ditch effort to restore a bad circumstance.