Finance Blogs Fundamentals Explained

Financial resources can push anyone to the factor of severe anxiety and also fear. Easier said than done, planning funds is not an egg implied for every person's basket. And also that's why https://www.washingtonpost.com/newssearch/?query=best financial advice many of us are often living pay check to salary. Yet did any person tell you that it is actually not a tough task to satisfy your financial goals In this short article, we will certainly explore means on how to set monetary goals and afterwards in fact satisfy them easily.

Try using these steps: 1. Be Clear Regarding the Purposes Any type of objective (not to mention financial) without a clear goal is absolutely nothing even more than a wishful thinking. As well as this couldn't be extra true for economic matters. It is commonly claimed that cost savings is only deferred usage. Therefore if you are saving today, after that you must be crystal clear concerning what it is for.

As soon as the objective is clear, placed a financial worth to that objective as well as the moment framework. The crucial point at this step of goal setting is to note all the purposes, however little they might be, that you predict in the future as well as put a value to it. 2. Keep Them Realistic It's good to be a hopeful individual but being a pollyanna is not desirable.

It is essential that you maintain your objectives sensible in nature for it will assist you persevere and also maintain you inspired throughout the journey. 3. Account for Inflation Ronald Reagan when claimed "Inflation is as terrible as a mugger, as frightening as an armed burglar and as lethal as a hit man".

As a result make up rising cost of living whenever you are placing a financial worth to an economic goal that is far in the future. For instance, if one of your monetary objective is your boy's university education and learning, which is 15 years hence, after that rising cost of living would enhance the financial burden by greater than 50% if inflation is mere 3%.

4 Easy Facts About How To Manage Your Finances Described

4. Short Term vs Long-term Similar to every calorie is not the very same, the strategy in the direction of accomplishing every monetary objective will certainly not coincide. It is essential to bifurcate goals Click for more in other words term and also lengthy term. Generally of thumb, any economic goal, which is due in following 3 years must be called as short-term objective.

This bifurcation of objectives right into short-term vs long term will assist in picking the best investment instrument to accomplish them. Much more on this later when we talk regarding just how to attain monetary objectives. 5. To every to His Very own The journey of establishing monetary goals is an individualistic affair i.e

. A great deal of times we jump on the bandwagon of objective setting only to realize in the future that it was not indicated for us. It is necessary that your goals are really your objectives and also not motivated by somebody else. Take a tough look at this step at all the objectives you have actually established for after this action, you will certainly get on the means to accomplish them.

11 Ways to Accomplish Your Financial Goals Whenever we discuss going after any kind of financial objective, it is usually a 2 action procedure Making sure healthy savings Making smart investments You will need to conserve sufficient; as well as spend those cost savings sensibly to ensure that they expand driscollbarbaracorbinb563.jigsy.com/entries/general/how-to-invest-fundamentals-explained over a time period to help you achieve objectives.

Making Certain Healthy and balanced Cost savings Self awareness is the finest form of realisation and unless you choose what your present economic setting is, you aren't heading anywhere. This is the prime focus where you begin your journey of accomplishing financial objectives. 1. Track Costs The first and the leading thing to be done is to track your monthly expenditures.

The Only Guide for Financial Advice Websites

When you begin doing it vigilantly, you would certainly be amazed to see just how little costs amount to a big quantity. Additionally classify those costs into different container so that you recognize which bucket is eating the most of your pay check. This record keeping will certainly lead the way for cutting down on un-wanted costs as well as pump up your financial savings rate.

Pay Yourself First Usually, cost savings come after all the costs have been dealt with. This is a classical mistake which practically every person people do. We pay ourselves last!Ideally, this must be intended upside-down. We must be paying ourselves first and afterwards to the world i.e. we ought to be obtaining the prepared conserving quantity initially as well as after that manage all the expenses from the remainder.

cash flowing immediately right into various financial instruments (as an example common funds, retired life corpus etc) on a monthly basis. Taking the automatic path will make us shed control of our money as well as therefore will certainly urge us to handle in what's entrusted to us thus boosting the savings rate. 3. Make a Plan as well as Oath to Stick with It Budgeting is the most effective to navigate the uncertainty that economic plans always pose.

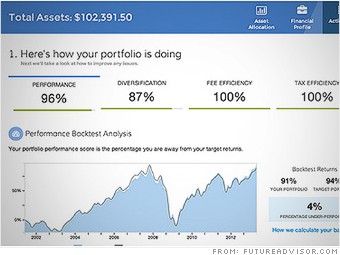

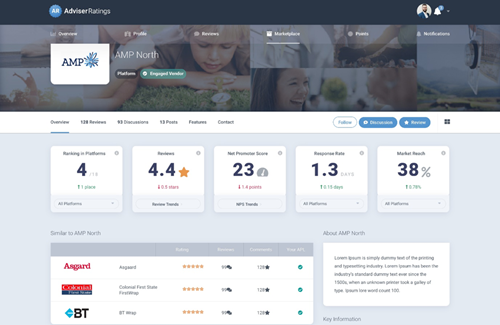

Nowadays, a number of finance apps and budgets can aid you do this automatically. It's simple and who recognizes, you might just end up doing what individuals fail to do. Initially, you might not have the ability to stick to your plans totally yet do not let that come to be a reason that you quit budgeting completely.

Discover choices financial advice website and also alternatives that let you use the offered pocketbook alternatives as well as pick the one that matches you the a lot of. In time, you will obtain accustomed to making use of these options. You will certainly discover that they make it simpler for you to follow your plan, which would have been hard otherwise.

The Only Guide for How To Manage Your Finances

Increase Again Even If You Fall Allow's be practical. It's not like the globe will come to an end if you made one blunder. This isn't called leniency yet technique. If you fail to fulfill your spending plan for a month, don't surrender the whole effort easily. Rather, begin again.

So go forward as well as attempt http://www.bbc.co.uk/search?q=best financial advice to follow your financial objectives http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/best financial advice as intended but if somehow, the plan obtains out of hand for you, do not quit on it just yet. This has a great deal to do with your psychology instead of any material dedication. All you need to do is to remain on the roadway and also oath to remain on it, no matter just how much you drop.

Make Financial Savings a Behavior and also Not an Objective In the publication Push, writers Richard Thaler as well as Cass Sunstein advocate that in order to attain any objective, it should be damaged down right into habits since practices are more instinctive for individuals to adjust to. Make Savings a habit as opposed to a goal.

For example: Always dine in a restaurant (if at all) throughout weekdays instead of weekends. Normally weekends are pricey. Make it a behavior as well as you would certainly subsequently be conserving a good deal. If you are travelling lover, try to travel during off period. Your outlay will certainly be a lot less. If you pursue buying, constantly keep an eye out for vouchers as well as see where can you obtain the ideal bargain.

Concentrating on the end result will bring out the feeling of sacrifice which will be more difficult to sustain over a time period. 6. Talk Concerning It Staying with the conserving routine (to achieve financial goals) is not an easy journey. There will be lots of interruptions from those that are not lined up with your goal.